When announcing the death of a monarch and the immediate succession of the next monarch, it’s traditional to utter the seemingly contradictory phrase, “The king is dead; long live the king!”

We hear a lot these days about the death of the 60/40 portfolio, which isn’t surprising since this has been one of the worst six-month periods for the king of asset allocations.

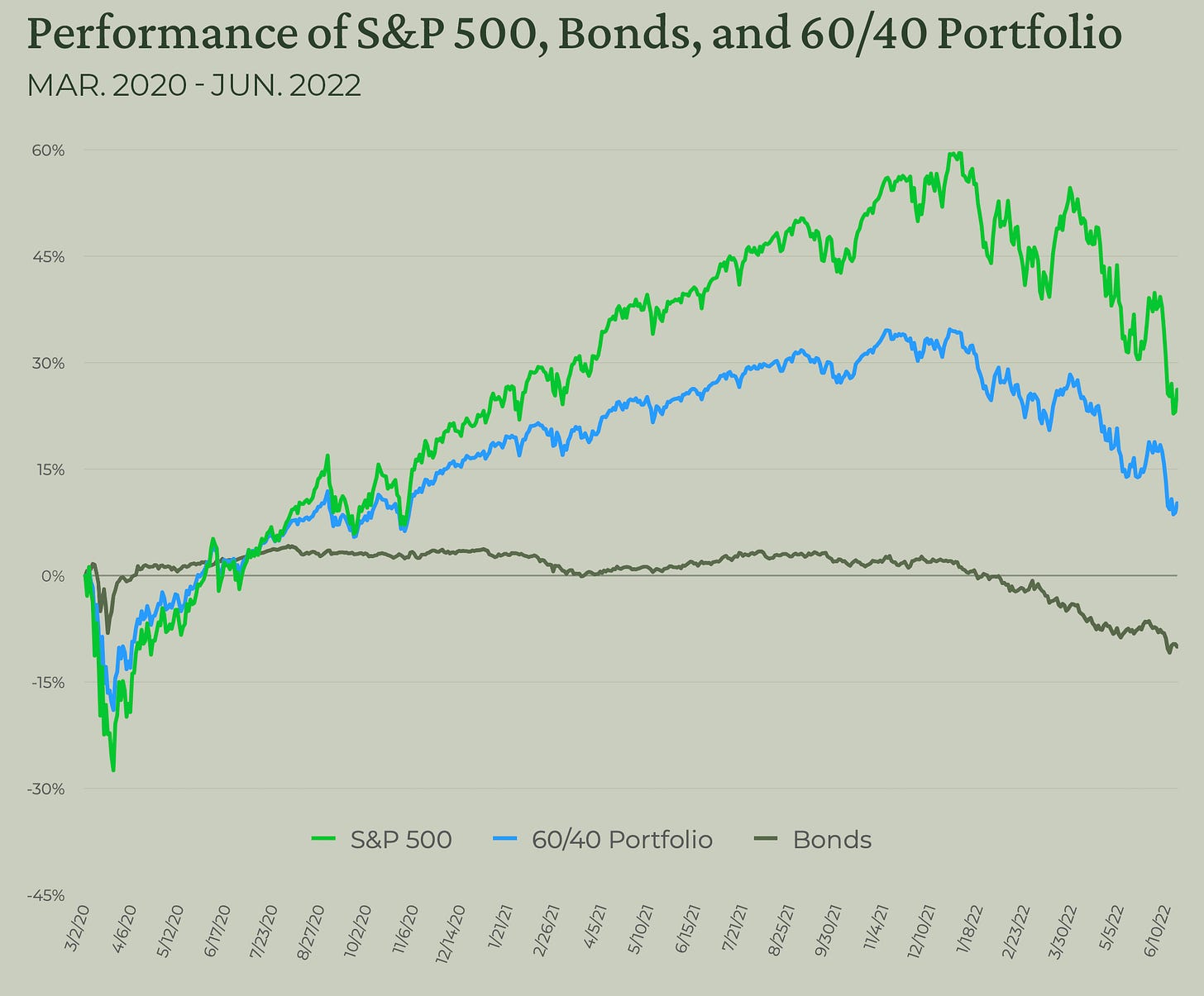

Since the beginning of the year, the S&P 500 is down by 21%, and core U.S. aggregate bonds are also down by 11%. Bonds are supposed to cushion the blow when stocks are down, but that hasn’t been the case in 2022. The typical 60/40 portfolio is down by 18%:

The 40% allocation to conservative bonds is supposed to support the 60/40 portfolio in times of crisis. That’s what happened, for example, back at the start of the housing crisis in 2007. In October 2007, when stocks started falling in earnest into the financial crisis, bonds held up much better and provided critical support to a 60/40 portfolio:

So why has the 60/40 portfolio been such a disappointment during this crisis? Is this just a temporary period of underperformance, or is it time to bury the 60/40 portfolio once and for all? Let’s take a deeper look.

First, a bit of history on the 60/40 portfolio. As best as I can tell, the concept was first introduced by John Bogle, the founder of Vanguard. The 60/40 portfolio was the ultimate easy answer to the question that all investors have of how to succeed in the markets. The simple message was, just buy a couple of Vanguard index funds supported by a little Modern Portfolio Theory (MPT) and you’re set for life! You can get the best of both worlds (stocks and bonds), low fees, and never have to think or worry again.

Famed author and financier Peter L. Bernstein, author of Against the Gods: The Remarkable Story of Risk, followed up his wildly popular 1996 book with an influential essay in Bloomberg in 2003 singing the praises of the 60/40 portfolio. He said:

Investment management provides only one dependable way to survive through the uncertainty of the future: diversification. Diversification means owning assets that do not move up and down together – a portfolio designed to subdue volatility rather than to maximize returns while still exposing you to the widest possible range of positive opportunities.

Sound familiar? Risk Rituals readers know that I’m a fan of MPT and believe that it plays an important role in financial decision making.

For the 60/40 portfolio to work (i.e., provide diversification), stocks and bonds need to “not move up and down together.” In other words, they need to be uncorrelated or even negatively correlated.

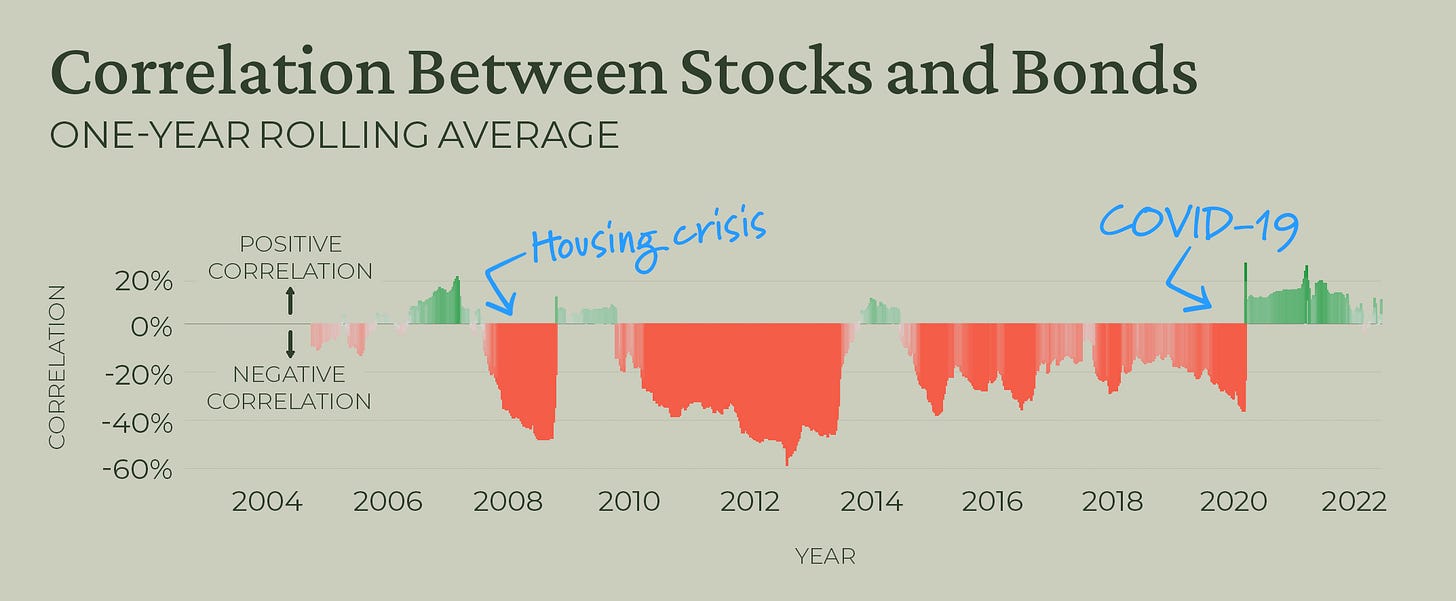

Let’s take a look now at how stocks and bonds have been correlated over the past couple of decades. This chart goes back to 2004 and shows the rolling one-year correlation between stocks ($SPY) and bonds ($AGG).

The green sections above the 0% line are periods of time when stocks and bonds tended to move up and down together. The red sections below the 0% line are times when stocks and bonds tended to move in opposite directions from one another:

Stocks and bonds were negatively correlated more often than they were positively correlated – as shown by the greater amount of red than green on the chart above. The average one-year correlation over this period time was -15%.

What we also see in the chart above, however, is that we’re currently in the longest period of positive correlation between stocks and bonds in the past 20 years. Since March 2020, the start of the COVID-19 crisis, stocks and bonds have tended to move up and down together.

Here’s what that looks like in terms of the prices of stocks, bonds, and the 60/40 portfolio:

It’s extremely unusual to have stocks and bonds positively correlated for such a sustained period. Stocks and bonds were positively correlated back in 2006–2007, prior to the housing crisis, but as we saw above, once the housing crisis kicked in, bonds played their traditional flight-to-safety role and didn’t decline along with stocks.

What’s different this time?

Central banks, led by the U.S. Federal Reserve, have played an unprecedented activist role in markets during the COVID-19 crisis. Moreover, the Fed did so after never fully unwinding its then unprecedented (though now quaint by comparison) interventions in the 2008 housing crisis.

We are all living in the Fed’s world now, and it has gotten so extreme that all financial assets – stocks and bonds – are moving up and down together based on the perceived intentions of the Fed.

The biggest market moving-events these days are the Fed’s monthly meetings and Chairman Powell’s subsequent news conferences. Even mid-meetings or mere comments from Federal Reserve officials move markets. Powell has been testifying in front of the House and the Senate this week – moving markets with his testimony. The only question on investors’ minds these days seems to be whether or not the Fed can hold it all together.

This is a terrible place for markets to be. These are not free markets. These are Fed markets. If our markets are going to be restored to something more balanced, it’s going to come from the Fed fading into the background rather than, once again, trying to be the hero riding in on the white horse to save us all.

Chairman Powell, please spare us your “transparent guidance.” Just shut up and get out of the way. We don’t need you. We don’t want you. You got us into this mess with your unprecedented funny-money printing, and you’re not capable of getting us out of it.

Until the Federal Reserve is a market afterthought instead of being the market thought, the 60/40 portfolio will not provide the diversification that it’s intended to provide. Investors will be on their own to find authentic diversification elsewhere – and it won’t be easy. In a purely narrative-driven centralized world, history is not a reliable guide.

Trust me though, this won’t be the death of the 60/40 portfolio. It’s a far too useful marketing tool for the financial services industry.

The 60/40 portfolio is dead; long live the 60/40 portfolio!

People seeking answers to why the market plunged usually emphasize the immediate events that precipitated a selling panic, when in fact these events are but minor symptoms of much more severe underlying problems.

Seth Klarman, Billionaire Hedge Fund Manager

Very well written article Richard. A lot of things make sense based on your analysis, especially in the Covid times. So, the question is, if the 60/40 portfolio is dead, what kind of portfolio does a regular investor invest in?

Great summary Richard. I think the 60/40 portfolio is way too simplistic and risky for the average retail investor and will continue to suffer for a while with stagflation.