October is nearly always a scary time for markets. For some reason, year after year, we seem to love to scare ourselves silly starting in late July and peaking in early to mid-October. It’s as predictable a thing as there is in markets.

Believe me, I’m not trying to belittle the very legitimate fears that are brewing out there. I’m as focused on multiple crises as anyone right now. What intrigues me is why we collectively indulge “peak fear” in the month of October, and we do so over and over again.

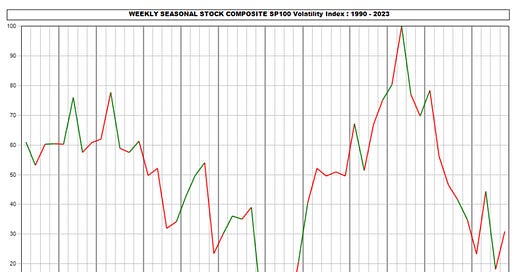

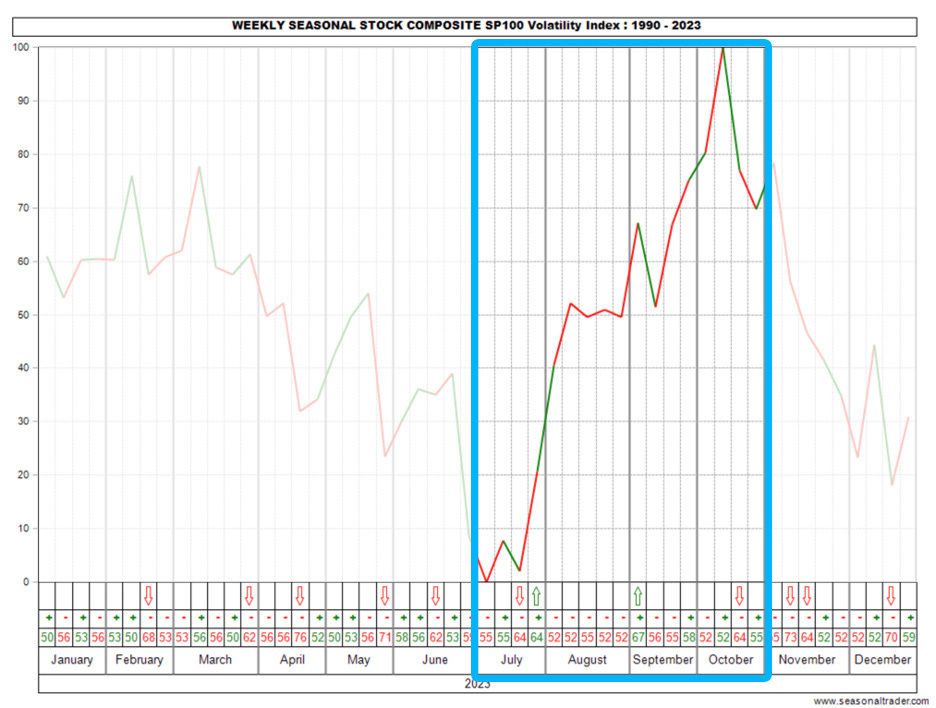

Here’s a chart showing the average annual performance of the S&P 100 Volatility Index (aka the “fear index”) from 1990 to 2023, sourced from my friend Jake Bernstein’s SeasonalTrader.com service (the first financial website I ever built).

The only thing I really want you to take away is the sharp rise in volatility starting in July and concluding about one week from now, i.e., the second week of October.

Right on cue, Bloomberg’s John Authers provided some exquisite “horror-chart porn” earlier this week. This lovely specimen shows how closely the Nasdaq 100 of 2023 has been tracking the Dow Industrials of 1987 since the beginning of 2023.

Yes. Should the pattern hold, we can expect the Nasdaq 100 to crash by 30% or so come Monday.

Now, please don’t go and sell all your stocks based on this chart! It’s just interesting, and important, to look at our collective behavioral patterns.

It’s particularly important because the only thing that is surer than the crash fears coursing through us all today is that by December we’ll likely all be wondering what on earth we were so worked up about.

Doubtful? I’ve got the chart to prove it.

Here’s the average annual performance of the S&P 100 over the same 33-year period from 1990 to 2023.

Again, all I really want you to see is that for the last 33 years, the S&P 100 has had its strongest performance of the year from the second week of October through the end of December.

It’s almost as if we build the wall of worry from July through September that markets then climb from October to December.

Again, I am as uncomfortable with markets today as I’ve ever been. I believe that there is as much potential for a 1987-style crash as I’ve seen in 25 years.

I’m watching markets like a hawk right now for major cracks, and major cracks there are. To mention one, prices for long-term Treasuries are down over 45% from their peak, and bond king Bill Gross isn’t yet backing up the truck.

But I’m also keeping an eye on history, and history says that it’s more likely that stocks will be higher at the end of December than they are today, and that we will likely continue to focus on our fears for a few more weeks before the fear tide recedes.

It’s amazing to look back just two weeks ago when Fed Chair Powell was asked if a soft landing is now the base case for the economy, while this week all the news has been about the increasing likelihood of a recession and collapsing long-term Treasuries.

Right about the time that everyone else finally starts to agree with me about how bad things really are, I’ll start looking for the right time to take the opposite side of that bet. History tells us that time starts toward the end of next week.

That is, if we survive next week (cue the sinister laugh track).

Fight the noise,

Dr. Richard Smith

P.S. In my role as Chairman of the Board for the Foundation for the Study of Cycles, I’ve been devoting a lot of time lately to some exciting plans that I think will interest investors. Please sign up for the newsletter to find out more about what’s to come in 2023!