Yesterday Chairman Powell took to the podium and read us all a comforting fairy tale that he had composed with his fellow members of the FOMC.

“Once upon a time, there was a nation and a people who had been living beyond their means for generations because their Feddy godmother, the Federal Reserve, had been giving them free money. Eventually, however, the money wasn’t free anymore, but the economy still chugged along up the ‘higher for longer’ hill just like the little engine that could.”

The big news was that Fed officials expect the fed funds rate to be at 5.1% at the end of 2024. This is higher than the 4.6% forecast they offered the last time they met back in June. In other words, they predict that the cost of money is going to stay higher for longer – a lot longer.

The reason that they see borrowing costs staying higher for longer is because consumer spending and the labor market have been surprisingly resilient over the past year in spite of higher borrowing costs. In fact, they lowered their estimate for unemployment at the end of 2024 to just 4.1% instead of their 4.5% forecast from the end of June.

So, borrowing rates are going to stay higher for longer, but spending and jobs are likely to stay abundant and plentiful.

I don’t think so.

Friends, the Federal Reserve is trying to engineer a recession plain and simple. That is what they must do in order to slow the economy that they previously caused to overheat. That is how it works.

A few weeks ago, I mentioned that recessions don’t happen when the Fed is slamming on the brakes. Recessions happen when the Fed starts to take their foot off the brake – when things start to “normalize.”

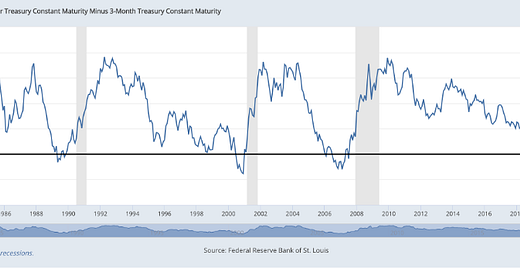

This normalization process is best captured in the 10-year minus 3-month Treasury spread. Below, the chart from the Federal Reserve shows the yield spread back to 1982 along with the gray recession indicators.

What I want to point out again is that the recessions happen after 3-month yields stop rising faster than 10-year yields. Recessions happen after this curve starts to head up instead of down – which is where we are today.

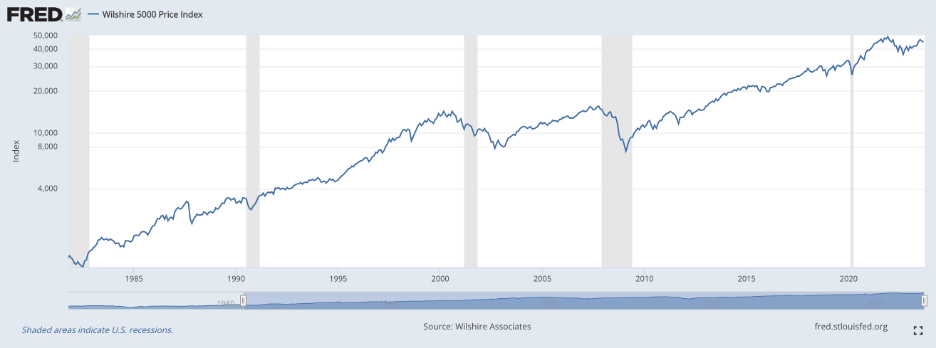

In case you were wondering, here is what has happened to stocks during past recessions dating back to 1982. (I used a semi-log scale chart so that the earlier corrections would be more visible.)

Recession and stock-market correction is what we should all be expecting instead of the soft-landing fairy tale that the Federal Reserve and the media would like us to believe.

Market action post fairy-tale press conference indicates that the market is getting the real message.

Fight the noise,

Dr. Richard Smith

P.S. In my role as Chairman of the Board for the Foundation for the Study of Cycles, I’ve been devoting a lot of time lately to some exciting plans that I think will interest investors. Please sign up for the newsletter to find out more about what’s to come in 2023!